The Franklin County Auditor is at the center of administrative efficiency and transparent governance and is the steward of real estate-related information within his jurisdiction. A model of civic responsibility, this important office plays a vital role in maintaining accurate and accessible records of real estate ownership, assessments, and tax assessments. As the guardian of fiscal integrity, the Franklin County Auditor has the responsibility to ensure a fair and equitable distribution of the tax burden among property owners. Franklin County Auditor’s commitment to technological advancement in the complex real estate landscape is evident through its easy-to-use online platforms. These digital portals allow residents, researchers, and businesses to easily navigate the wealth of real estate information contained in departmental records. From intuitive property research tools to comprehensive reports, the Auditor’s Office leverages the power of technology to provide a smooth, seamless experience for anyone seeking information on real estate matters.

Franklin County Auditor’s commitment to technological advancement in the complex real estate landscape is evident through its easy-to-use online platforms. These digital portals allow residents, researchers, and businesses to easily navigate the wealth of real estate information contained in departmental records. From intuitive property research tools to comprehensive reports, the Auditor’s Office leverages the power of technology to provide a smooth, seamless experience for anyone seeking information on real estate matters.

As a cornerstone of local government, the Franklin County Auditor reflects the county’s commitment to openness, accessibility, and fair government. This introduction lays the foundation for understanding the critical role this office plays in fostering a community where real estate information is not just a record, but a gateway to informed decision-making and civic engagement.

Property Search Steps for Franklin County Auditor Property Search

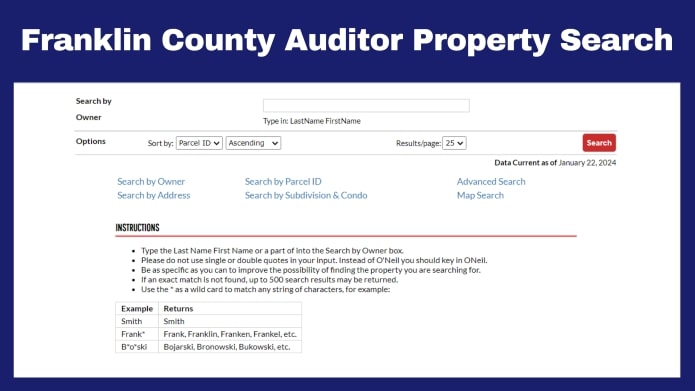

Here are simplified steps of the Search by Owner Franklin County Auditor property search:

- Visit the WWW Franklin County Auditor website(www.property.franklincountyauditor.com).

- Find the Franklin County Auditor property search section.

- Click “Search by owner”.

- Enter the owner’s name (full or partial).

- View the list of properties associated with this owner.

- Click on a Franklin County Auditor property search for more information.

- Check property features, ownership history, and tax details.

- Go back or refine your search if necessary.

- When finished, exit the Franklin County Auditor Property Search tool.

By following these simple steps, you can easily search for real estate information in Franklin County using the search-by-owner method.

Franklin County Auditor – Open Data Portal

The Franklin County Auditor’s Open Data Portal is the county’s public platform for accessing, exploring, and downloading publicly available open data. These data products are provided as part of the Comptroller’s transparency initiatives and commitment to the citizens and business community of Franklin County to ensure a truly open government. The data found on this portal is in the public domain and can be used to inform the public and businesses so we can solve important local issues together. Let’s work together to make our great communities even better.

Most of the data used by the Franklin County Auditor’s Office can be downloaded and updated regularly. Each dataset is in the public domain and can be used by citizens and diverse business communities to answer complex questions. These data sets are the same as those used by the targeted application that the audit office offers to the public.

This ensures that analytics capabilities are consistent whether a user is downloading data for use in their applications or using one of our published applications. We encourage you to explore these datasets and expand your knowledge, as we hope they will have a tremendous impact on your communities and your industry. We also welcome your comments through the “Contact Us” section below. Your comments and suggestions can help us develop these features further.

Fireworks Permit Application

The Franklin County Board of Supervisors charged a registration fee for fireworks permit applications. The council decides the following:

- All fireworks permit applications submitted outside of the state-authorized dates of June 1 through July 8 and December 10 through January 3 by Iowa Code SF489 will be subject to a fee of U.S. $10.00.

- Any application for a fireworks permit not accompanied by a $10.00 application fee will not be considered for issuance by the Franklin County Board of Supervisors.

- The application fee is a non-refundable license review fee and is non-refundable if the fireworks license is not granted.

- The Board of Supervisors only has jurisdiction over unincorporated areas of Franklin County.

Rental Property Registration

Do you own a rental property? In this case, Franklin County Auditor Ohio Revised Code (ORC) section 5323.02 requires the owner of a residential property to record certain information with the county’s auditor. For more information and links to online registration and forms, visit the Franklin County Auditors Rental Registry.

If you need information about the value of your property, simply click on the “Search Property” button on the WWW Franklin County Auditor (www.property.franklincountyauditor.com) to Franklin County Auditor Know Your Home Value and enter the Franklin County Auditor Search by Address details. We typically use this page to confirm tax status, which indicates which departments, cities, or counties would report to your home. (i.e., Norwich Township, Town of Hilliard, or City of Columbus). Callers often have a zip code in Hilliard but live in Columbus. Columbus Services would, therefore, be the right contact.

The Franklin County Auditor regularly reviews property values. If you want to know if or when they are in your area, simply click the “Appraisers in your community” button to learn the details and see a map of properties currently being appraised.

Did you know that you can contact the auditor if you think your property valuation needs corrections? Additionally, if your home is damaged by a storm, fire, or other means, state law allows auditors to reduce the value of your property temporarily. If the unthinkable happens, simply click HERE to view the Damaged or Destroyed Property form on the WWW Franklin County Auditor(www.property.franklincountyauditor.com).

Reappraisal Guide The 2023 Property Reappraisal

Franklin County Auditor Ohio law requires the county auditor to update all property values statewide every three years to reflect recent market changes. The 2023 reassessment will include an exterior visual inspection of all properties in Franklin County. Notification of your preliminary value will be sent in August 2023. If you do not agree with your preliminary value, you can attend a valuation of your property in September 2023. All final values will be determined in December 2023. Final Values, as well as your taxing district, could affect your 2024 property taxes.

If you do not agree with your preliminary value, you can attend a valuation of your property in September 2023. All final values will be determined in December 2023. Final Values, as well as your taxing district, could affect your 2024 property taxes.

What is your role in establishing your property value?

All property owners can work with the Auditor’s Office to provide information to reevaluate their proposed values by speaking with an appraiser virtually or in person in September 2023. Your participation will help the Office prepare the appropriate appraisal. Owners will also have access to the review board process in 2024 if they believe the final score is inaccurate.

How is my property value determined?

The 2023 real estate revaluation includes a visual inspection of a property’s exterior condition to other properties in the neighborhood and other features. Additional features for setting property values include:

- One of the most important factors is recent home sales in your neighborhood.

- Neighborhood data is an important metric used by appraisers to determine a property’s value.

- Physical characteristics such as the home’s age, condition, and renovations also affect market value. (614) 525-HOME auditorstinziano@franklincountyohio.gov

Will the reappraisal affect my taxes?

Perhaps. The process does not aim to increase or decrease taxes; However, this may affect your taxes. The Franklin County Auditor’s Office is required by law to conduct the reappraisal and strives to provide the most accurate and fair property appraisal possible. As you may know, taxes are set at the polls in your taxing district based on voter approval.

Meet The Team of Franklin County Auditor’s Office

Auditor – Katy Flint – Katy was raised in Franklin County and graduated from Hampton-Dumont High School. He attended Wartburg College, where he studied American history, world history, and secondary education. After teaching for two years in southern Iowa, Katy returned to Hampton where she worked a variety of jobs. Before being elected auditor, she served as Sheffield City Clerk for six and a half years. She was originally elected auditor in 2021. She is married, has two stepchildren, and has a fur baby!

Deputy Auditor – Amy Holmgaard – Amy Holmgaard. Amy is a lifelong Hampton resident. He graduated from Hampton High School and Iowa State University. He has been a member of the Comptroller since 1993.

Human Resource Director – Audrey Emery – After living her entire life in Iowa, Audrey began her work as a human resources professional by joining the Iowa Army National Guard during her senior year of high school. After returning from basic and advanced training, he attended Luther College before choosing a full-time career in the National Guard, which included a tour of duty in Kuwait for Operation Iraqi Freedom. After ten years of service, she entered the civilian workforce as a human resources administrator for National Farmers in Ames. Audrey currently serves as the Human Resources Franklin County Auditor Directory since May 2019.

Drainage Clerk – Colette Bruns – Colette is a native of the Dumont area and a graduate of Dumont Community High School and Ellsworth Community College. He has been in the controllership since February 2020.

Finance Assistant – Tanya Demro – Tanya completed her graduation from Dike-New Hartford High School. She moved to Hampton in 2014 when her husband got a job as a lineman at the Franklin County REC. Together they have 4 young children. He attended college at NIACC, where he received his AA in Accounting. He joined the review in April 2021.

| GENERAL OFFICE HOURS | Monday-Friday | 8 a.m. – 5 p.m. |

|---|---|---|

| PUBLIC COUNTER HOURS | ||

| Fiscal (21st Floor) | Monday-Friday | 8 a.m. – 5 p.m. |

| Licensing (21st Floor) | Monday-Friday | 8 a.m. – 4 p.m. |

| Board of Revision (20th Floor) | Monday-Friday | 8 a.m. – 4 p.m. |

| Manufactured Homes (20th Floor) | Monday-Friday | 8 a.m. – 4 p.m. |

| Transfer & Conveyance/Homestead (19th Floor) | Monday-Friday | 9 a.m. – 12 p.m. and 1 p.m. – 4 p.m. |

About Franklin County Auditor

The auditor’s office oversees the county’s weights and measures, ensuring consumers get what they pay for at gas pumps and retail scanners. The auditor also serves as the county’s chief financial officer and protects county revenues through innovative ideas and initiatives that protect Franklin County residents.

The Comptroller also has several important responsibilities that affect all Franklin County residents and businesses. The office sets property values that determine property taxes and helps seniors, veterans and people with disabilities obtain tax incentives.

The Comptroller strives to be accessible, transparent, and accountable to the people of Franklin County. Provides accurate information and services to residents, businesses, and government agencies throughout the county in a timely and cost-effective manner.

FAQs

How are Franklin County property taxes calculated?

The tax rate, or millennial rate, is set annually by the Franklin County Commissioners and the Franklin County Board of Education. A tax rate of one million means a tax liability of one dollar per $1,000 of assessed value. Each government agency estimates its total revenues from other sources.

What is the Franklin County Auditor Property Tax Assistance Program?

The Property Tax Assistance Program (PTAP) is a group that provides one-time financial assistance to eligible seniors or individuals with documented permanent disabilities for partial or full payment of homeowners’ current property taxes.

What is the Homestead Exemption Program?

The Homestead Exemption Program allows seniors and permanently disabled Franklin County Auditor Ohio residents who meet the state’s annual income requirements to reduce their property tax burden by shielding a portion of their home’s market value from taxes.

Conclusion

In short, the Franklin County Auditor is the linchpin of transparent governance, ensuring fair distribution of taxes and keeping careful records of assets. Through user-friendly online platforms, it provides residents with easy access to property information and transforms data into informed decisions. This office acts as a guardian of transparency, transforming real estate information into a tool for community engagement and empowerment.